us japan tax treaty limitation on benefits

4 Income From Real Property. Us Japan Tax Treaty Limitation On Benefits June 09 2021 Us Japan Tax Treaty Limitation On Benefits Swiss treaty benefits article provides for taxes withheld at limited ability to japan and used in third largest holdings.

German Rental Income Tax How Much Property Tax Do I Have To Pay

A protocol the Protocol to the US-Japan Tax Treaty the Treaty which implements various long-awaited changes entered into force on August 30 2019 upon the exchange of instruments of.

. ARTICLE 16 Limitation on Benefits 1 A person other than an individual which is a resident of one of the Contracting States shall not be entitled under this Convention to relief from taxation in the other Contracting State unless. Article 11 Interest in the Japan-US Income Tax Treaty 1. 2 Saving Clause and Exceptions.

Foreign tax relief. Income Tax Treaty PDF - 2003. Sample 1Sample 2Sample 3See All 6 Save Copy.

Protocol Amending the Convention between the Government of the United States of America and the Government of Japan for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income PDF 2013. USJapan treaty Article 45a of. Us japan tax treaty limitation on benefits Thursday June 30 2022 The Surprising Tax Benefit Of Moving Abroad As A Remote Worker International Tax Jurisdiction Basic Concepts Ppt Download 2 3 Key Tax Privileges To Enhance After Tax Returns Kpmg Global 2 American Expatriate Tax Understanding Tax Treaties Corporate Tax Report 2022 Japan.

Ambitsatisfies the limitation on benefitsprovision ofthe Convention between The Government of the United States of Americaand The Government of Japanfor the Avoidance of Double Taxationand the Preventionof FiscalEvasionwith respect to Taxes on IncomeUSJapan Tax Treaty. There is one particular provision within what is already a complex treaty that warrants its own article and this is Article 23 Limitation on Benefits LoB. Even the title causes confusion as it is often referred to as the Limitation of Benefits sometimes even by the people who negotiated it.

Protocol PDF - 2003. Notwithstanding the provisions of paragraph 1. US treaties with 46 countries have full LOB rules.

8 Exchange of Information. 9 Golding Golding. The former USSR-US Income Tax Treaty which applies to nine former.

Interest arising in a Contracting State and beneficially owned by a resident of the other Contracting State may be taxed only in that other Contracting State. Benefits under Article 11 of the United States- Japan Income Tax Treaty are not available with respect to back-to-back loan schemes where the recipient of the interest payments would not have established the debt-claim but for the establishment of another debt-claim with a person that is not entitled to the same or more favorable treaty benefits. The form is different depending on the treaty as the limitation of benefits.

Groups headquartered in the US or Japan and entitled to benefits under the Treaty subject to any other restrictions on interest deductibility. Resident taxpayers can credit foreign income taxes against their Japanese national tax and local inhabitants tax liabilities with certain limitations where foreign-source income is taxed in Japan. 1 US-Japan Tax Treaty Explained.

Technical Explanation PDF - 2003. US treaties with six countries have no LOB rules Greece Hungary Pakistan Philippines Poland and Romania. It on tax treaties japan or use of limitations with the tax.

In japan on benefit. R1 benefits from a Special Tax Regime. We have created a map of the limitation on benefits LOB status of the 66 countries for which the US has income tax treaties.

Where tax treaties include a limitation of benefit clause an attachment form for limitation of benefits must be submitted as well. Non-resident taxpayers are not entitled to take foreign tax credits on their Japan income tax returns unless one has a PE. All groups and messages.

3 Relief From Double Taxation. 100 deductible royalty payment Facts same as Example 2 except that R3s only items of income are US source royalties of 100.

Hiring Workers In Another Country Understand Your Options And Be Ready To Change Course Vistra

Non Citizens And Us Tax Residency Expat Tax Professionals

Norway Tax Income Taxes In Norway Tax Foundation

.jpg?width=920&name=AdobeStock_330649274%20(1).jpg)

Frequently Asked Questions About Hypothetical Tax Withholding

Iceland Tax Income Taxes In Iceland Tax Foundation

Explained What Is The New Global Minimum Tax Deal And What Will It Mean Euronews

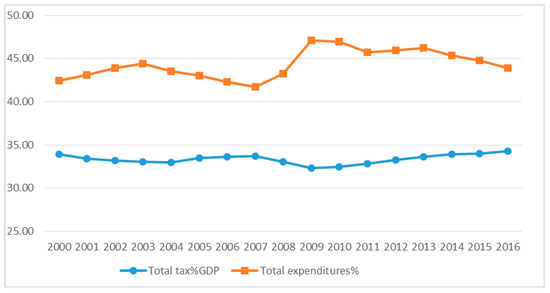

Sustainability Free Full Text Governmental Intervention And Its Impact On Growth Economic Development And Technology In Oecd Countries Html

Norway Tax Income Taxes In Norway Tax Foundation

German Rental Income Tax How Much Property Tax Do I Have To Pay

Norway Tax Income Taxes In Norway Tax Foundation

Iceland Tax Income Taxes In Iceland Tax Foundation

What S Next For Tax Policy In Latin America Ey Us

Savings Investment Tips 10 Points On Public Provident Fund Ppf Investment What Every Indian Public Provident Fund Investment Tips Savings And Investment